Introduction

The AccurateTax integration to Stone Edge allows users to calculate sales tax on orders using their sales tax API.

Settings

Set System Parameters

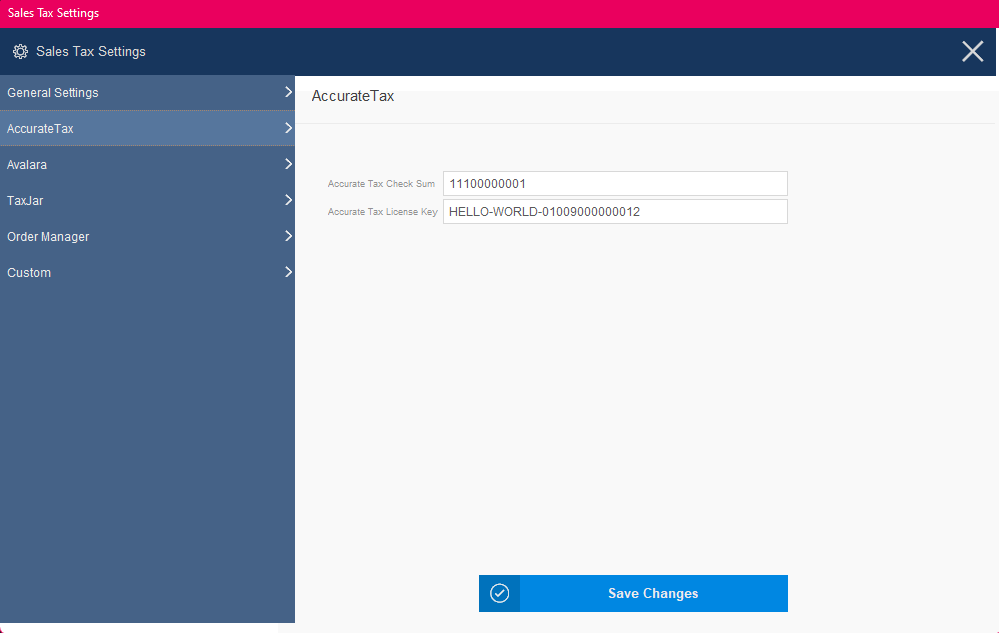

- Set the following system parameters by going to Settings > System Functions > Sales Tax Settings.

- AccurateTaxCheckSum: This is obtain from your AccurateTax account

- AccurateTaxLicenseKey: This is obtain from your AccurateTax account

- SalesTaxSystem: Set this to “AcurrateTax” to make this the default tax system used for all orders.

- POSSalesTaxSystem: Set this to “AcurrateTax” to make this the tax system used at the Point of Sale screen.

- Continue by setting your company address information with the following parameters:

- TaxAddress1

- TaxAddress2

- TaxAddress3

- TaxCity

- TaxState

- TaxCountry set to US

- TaxZip

- If using POS there are separate parameters for each of the ones mentioned above…POSTaxAddress, POSTaxCity, POSTaxState, etc…

- POSTaxAddress1

- POSTaxAddress2

- POSTaxAddress3

- POSTaxCity

- POSTaxState

- POSTaxCountry set to US

- POSTaxZip

- For an increased performance at the Manual Orders Screen, you may consider setting “LimitAPICalls” to True. Enabling this parameter will reduce the number of API calls to the SalesTaxSystem of your choice by only calculating taxes when you go to the “Pricing Tab” in the Manual Orders form.