Version 7.5

Version 7.5

Contents of this Topic: Show

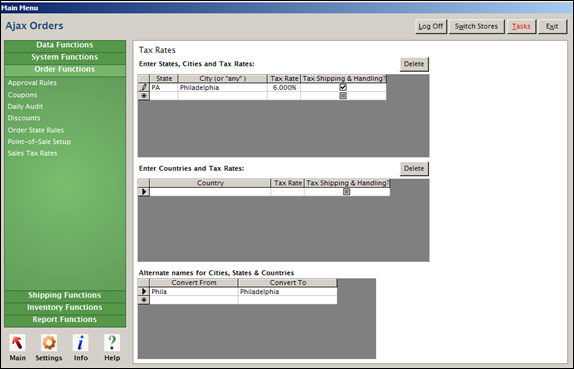

Main Menu>Settings>Order Functions>Sales Tax Rates

Tax Rates screen

Enter the two-letter state abbreviation in the State column. Do not enter the entire name of the state.

Note: It does not matter whether the state abbreviation is upper- or lower-case. You can specify an alias in the Alternate names for Cities, States & Countries section.

If you DO NOT need to specify tax rates for cities within the state, enter "any” (without quotes) in the City column. Otherwise, enter the name of the city.

Enter the tax rate as a percentage in the Tax Rate column.

If shipping and handling fees are taxed by the state, click the check box in the Tax Shipping & Handling? column.

Enter a two-letter Country Code in the Country column. Refer to the ISO 3166 English Country Names and Code Elements to find an appropriate value.

Enter the tax rate as a percentage in the Tax Rate column.

If shipping and handling fees are taxed by the country, click the check box in the Tax Shipping & Handling? column.

If necessary, specify an alias in the Alternate names for Cities, States & Countries section.

![]() This information is used to auto-correct data entry "errors” in address fields at the time an order is imported into SEOM. This feature does not affect manually entered orders.

This information is used to auto-correct data entry "errors” in address fields at the time an order is imported into SEOM. This feature does not affect manually entered orders.

Created: 3/14/12

Revised:

Published: 04/14/16